The Union Cabinet’s latest resolutions mark a strategic pivot towards social welfare and industrial vitality. Extending the Atal Pension Yojana through FY 2030-31, with bolstered budgets for promotion and financial gaps, ensures enduring support for India’s informal economy participants. Complementing this, Rs 5,000 crore equity for SIDBI promises to democratize credit for MSMEs.

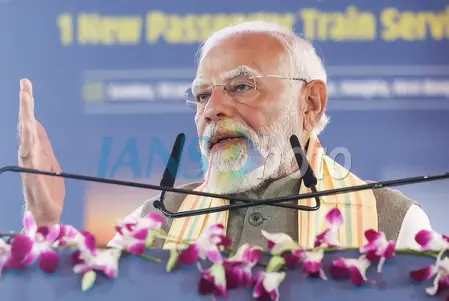

Since its inception in 2015, APY has transformed retirement planning for the masses, offering guaranteed pensions of Rs 1,000 to 5,000 monthly from age 60. Enrollment milestones—surpassing 8.66 crore by 2026—highlight its success in penetrating low-income brackets. The prolongation, approved under PM Modi’s stewardship, includes proactive measures to amplify awareness and sustain scheme integrity.

Government visionaries see this as a stepping stone to pension universality, integral to the 2047 developed nation blueprint. Shifting gears to enterprise development, the SIDBI infusion—phased as Rs 3,000 crore in 2025-26 and Rs 1,000 crore thereafter—addresses impending asset growth from innovative lending products.

Forecasts are bullish: MSME beneficiaries could jump 33% to 1.02 crore, injecting 1.12 crore jobs via 25.74 lakh newcomers. Each unit’s average employment of four underscores the multiplier effect. Amid SIDBI’s thrust into unsecured digital finance and venture debt for startups, this equity fortifies risk buffers, preserving CRAR stability and investor confidence.

In essence, these policies weave security for the aged with momentum for small businesses, architecting an inclusive economy resilient against future shocks.