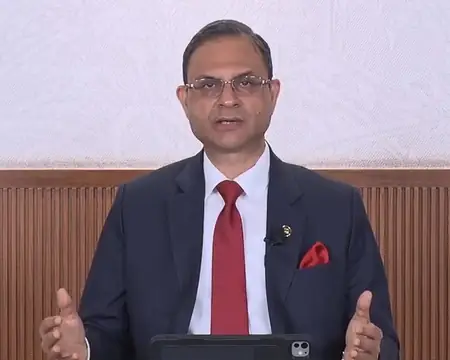

Reserve Bank of India Governor Sanjay Malhotra dropped a key update from Mumbai on Friday, promising relief for fraud victims. New rules will compel banks to compensate customers hit by small-scale digital scams.

Revisiting the 2017 liability norms for unauthorized transactions, the RBI has adapted to today’s tech-driven banking reality. The refreshed guidelines zero in on low-value fraud compensation, complete with structured payouts. Expect the draft version for public input any day now.

As fintech innovations accelerate, protecting users from electronic threats is paramount. The governor stressed defined liability caps and swift resolutions to empower consumers.

Shifting gears, the RBI is tightening the noose on improper sales of financial wares by banks and NBFCs. Mis-selling inflicts heavy damage—financially and reputationally. Hence, products peddled at counters must suit customer suitability and risk tolerance precisely.

Draft rules governing ads, marketing, and sales practices for regulated entities (REs) are forthcoming for feedback. In parallel, recovery agent guidelines get a unified makeover. Disparate codes for various institutions will consolidate, ensuring standardized, fair recovery tactics.

These forward-thinking policies reflect the RBI’s vigilant oversight. By prioritizing customer safeguards across fraud, sales, and collections, the bank is fortifying India’s financial defenses against modern risks.