This well-known quote by funding guru Warren Buffett on stock-picking seems to be wish to be driving retail investor participation in India’s stock markets. And, going by the shareholding disclosures for March 2023 quarter, many explicit particular person consumers seem to have provide you with their very personal stock-picking method: companies which is perhaps each filth low-cost or plain heavyweights.

The data, launched by Capitaline and BSE not too way back, provides an fascinating notion into retail investor behaviour. And the darlings of these consumers: Yes Bank, Tata Power, Tata Motors, Reliance Industries Ltd (RIL), Reliance Power and State Bank of India (SBI). Between them, these companies have a whole of 26 million retail shareholders.

Beaten-down shares

Yes Bank has the easiest number of retail shareholders (4.97 million), adopted by two Tata group companies and the others. The Yes Bank stock, though, delivered unfavourable 45% compound annual growth payment (CAGR) returns all through fiscal years 2018-23. Surprisingly, the lender observed a sharp surge throughout the number of retail shareholders between fiscal 2020 and 2023 when its stock obtained hammered after the Reserve Bank of India imposed on it a 30-day moratorium.

View Full Image

Graphic: Mint

Similar is the case with a lot of the totally different shares. For event, the number of retail shareholders in Adani Power stood at 549,000 as of FY2021 nevertheless it higher than doubled to 1.76 million as of FY2023. At Adani Ports, their numbers jumped from 390,000 in FY2021 to 1.07 million in FY2023. IDFC First Bank observed the numbers swell from 1.14 million in FY2021 to 1.65 million in FY2023. Telecom company MTNL’s case is rather more compelling. While its market share throughout the telecom sector nosedived, the number of shareholders surged from 153,459 in FY2021 to 180,512 in FY2023. JP Power, one different overwhelmed down stock, observed retail investor numbers skyrocket from 360,000 in FY2021 to 1.44 million in FY2023

All these numbers degree to the voracious urge for meals of retail consumers for beaten-down shares—scrips which have seen a sharp correction and the stock price has crashed to double- and even single-digits. For event, Yes Bank’s stock is presently shopping for and promoting at ₹16 per share, falling from a lifetime extreme of ₹404 in FY2019.

So, what makes retail consumers spend cash on these shares. “Retail consumers check out low-priced shares with expectations of seeing a turnaround some time later. They moreover sometimes miscalculate that there is hardly any additional room for a draw again after the stock has taken a heavy drubbing,” says G. Chokkalingam, founder of Equinomics Research & Advisory.

“Besides, since the prices are cheap, they can buy a larger number of the shares,” he gives. For event, an individual who must take a place ₹1 lakh should buy 1,000 shares of a corporation at ₹100 apiece nevertheless should buy double this amount if the value is ₹50 a share after which hope to make a sizeable income when the prices soar.

Business groups

It just isn’t solely beaten-down shares which is perhaps in model with retail consumers. The heavyweights, or well-known enterprise groups, moreover are more likely to see large retail shareholder participation. A dwelling proof: RIL, SBI and Tata Power are amongst these with the easiest number of such shareholders. RIL has moreover been a perpetual favourite of retail shareholders. The stock has delivered CAGR returns of 20.9% over FY18-FY23.

While SBI has a strong mannequin recall price as being one amongst India’s oldest banks with the nation’s largest division neighborhood, Tata Motors and Tata Power have benefitted from the newest push for electrical autos (EVs) by the federal authorities, the expansion of charging stations for such autos and an rising curiosity throughout the EV sector by the broader market.

All three of these shares have delivered 11.6%, 1.9% and 15% CAGR returns, respectively, all through FY18-FY23. Only RIL and Tata Power have managed to outperform the S&P BSE Sensex, which delivered a CAGR of 12% returns all through the equivalent interval.

Besides the favored heavyweights, explicit particular person shareholders have confirmed a liking for beaten-down shares of companies which is perhaps part of any conglomerate. Deepak Jasani, head of retail evaluation at HDFC Securities says, “Retail consumers generally tend to buy beaten-down shares of companies run by enterprise groups on hopes that passable measures is perhaps taken to unlock price. That is the rationale why there could also be heightened train by means of shopping for and promoting volumes and number of shareholders. Expectations of optimistic firm movement moreover act as magnets for higher participation of retail consumers.”

For example, Reliance Power of the debt-ridden Anil Ambani group has 3.5 million retail shareholders. The stock delivered CAGR returns of -26.8% over FY18-FY23.

While the brand value of Reliance and Tatas have made them popular among investors, the cheap prices of Yes Bank and Reliance Power have piqued interest of retail investors.

Shrikant Chouhan, head of equity research, Kotak Securities, says “It is observed that whenever any large-cap company is impacted by specific news alerts (particularly where it concerns corporate governance issues), FIIs and DIIs try to exit 100% and liquidate that holding in the open market. But retailers rush in with the hopes of exiting with quick profits. However, most of the time they get caught on the wrong foot.” FIIs is transient for worldwide institutional consumers and DIIs is the acronym for dwelling institutional consumers.

What consumers say

Hyderabad resident Khushal Sethia, 22, says he invested in Reliance Power in 2018 on the suggestion of his associates. He claims to have made a 50% income on the stock and freed his capital whereas the remaining stays to be invested in it.

Hiten Doshi, 24, a resident of Pune, says he invested in RIL due to its sturdy mannequin and a lot of M&A (mergers and acquisitions) affords being executed by the company. He didn’t know quite a bit in regards to the fundamentals of the stock, nevertheless was betting on RIL chairman and managing director Mukesh Ambani and the company’s success story.

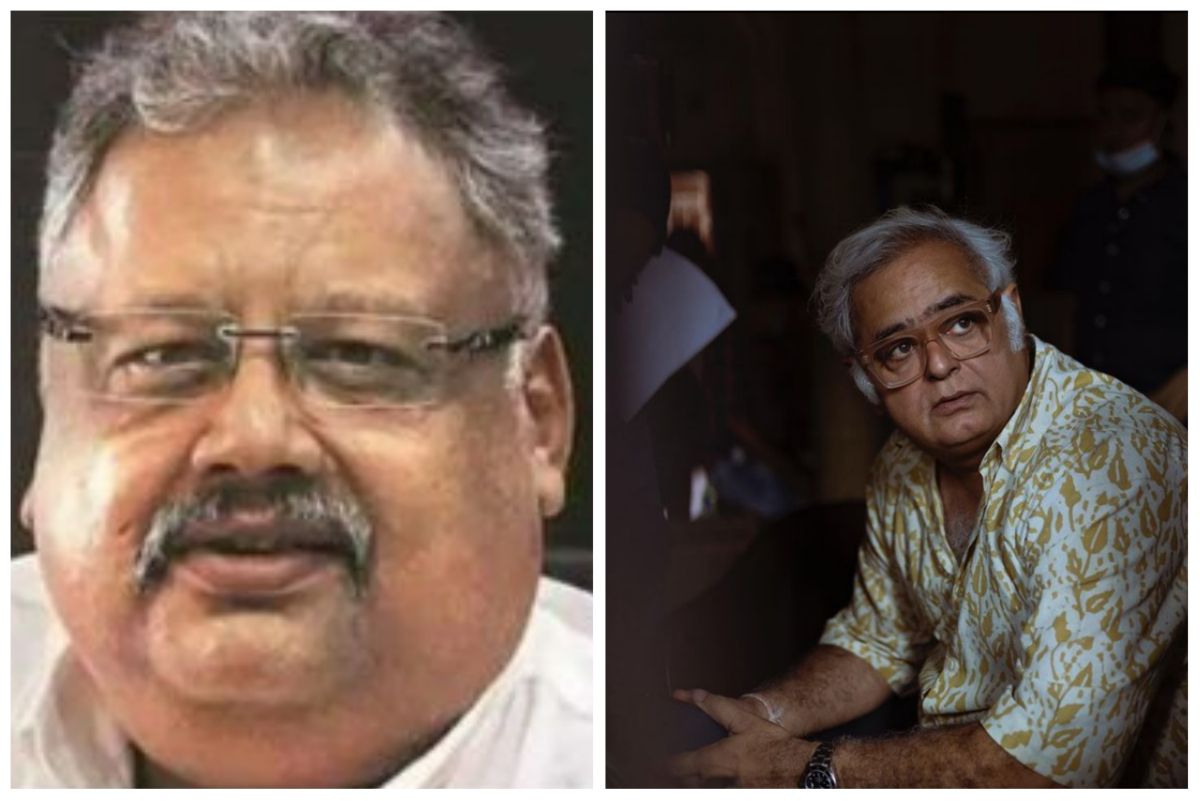

Rhythm Sharma, 23, says he invested in SBI, Tata Motors and Yes Bank. SBI is a trusted mannequin and the stock was on the market cheaply. As for Tata Motors, the Pune resident says, the company was the first to maneuver throughout the EV space and ace investor Rakesh Jhunjhunwala had moreover invested in it. Sharma claims that he invested a small amount in Yes Bank because of a funds stock price.

What to watch out for

Investors ought to concentrate to the returns from these shares and consider them with market benchmark S&P BSE Sensex. They can lose their funding capital if the beaten-down shares proceed to the contact new lows even after a correction. Betting on a corporation turnaround is like timing the market. And this can be very harmful.

“The absolute price of a stock doesn’t make it low-cost. It is the valuation which qualifies a stock as low-cost or not. Interestingly, over two-third of shares which finally get suspended from stock exchanges have been shopping for and promoting very low-cost in absolute phrases,” Chokkalingam says.

Therefore, one ought to understand the hazards and returns given by these shares over the longer interval sooner than investing in them. Many of these shares are merely in model because of their filth low-cost prices. Investing immediately in equity should not be easy. Getting into shares merely because of their low prices, instead of specializing of their fundamentals, can backfire if the anticipated turnaround in no way happens.

Catch the entire Business News, Market News, Breaking News Events and Latest News Updates on Live Mint.

Download The Mint News App to get Daily Market Updates.

More

Less

Topics